- The Lindy Newsletter

- Posts

- Making Money in the Gilded Age

Making Money in the Gilded Age

The economy is strange right now, it is both booming and breaking.

Layoffs are the highest since 2020. 58% of college grads are still job-hunting. Whether it’s AI eating entry-level work or just a recession happening, young workers are feeling the pain. We all know people who can’t get hired for jobs in this market.

"Hiring is at its lowest level since 2009," per CNBC

— unusual_whales (@unusual_whales)

2:17 PM • Oct 13, 2025

On the other hand, walk through any major American city and you’ll see the opposite. Restaurants full. New towers being built. Nearly one in five households (24 million in total) now boast seven-figure net worths. The stock market has charged upward for fifteen years. Americans live in big houses, drive multiple cars, and eat out constantly.

The United States is so rich that an American at the domestic poverty line is to the rest of the world what an American who earns $110,000 is to the rest of the US (among the top 15% or so of earners). And yes, this is PPP-adjusted

— Chris Freiman (@cafreiman)

1:00 PM • Jul 31, 2025

Sometimes those two worlds meet. You order a coffee and a muffin. The barista rings it up, $16.89, and laughs a little as she says it. That’s about what she makes in an hour. But every morning, a line of people is willing to pay it without thinking twice.

things are so expensive now the barista will sometimes laugh when saying the amount of money your order is

— LindyMan (@PaulSkallas)

12:41 AM • Oct 13, 2025

We’re essentially in a Gilded Age economy now of a good portion of the wealth at the top and a large amount of people floating around. This opens up space for strange ways to make money.

The Gilded Age Market

In normal times, making money means mastering something brutally hard. People become brain surgeons, tax attorneys, or software architects. They build intricate products for large corporations.

@chrisp.md How many years of schooling does it take to become a doctor in the US? #doctortok #medtok #premed #medschool #fypシ

But in a Gilded Age, another path opens, a more cunning one. Think about it. Millions of households now earn $300,000 to $850,000 a year. They’re not “rich-rich,” but they’re rich enough to inherit elite anxieties. They’ve secured the basics (housing, education, retirement) and now face other problems. More existential problems. Where capital and anxiety concentrate, new industries emerge, not for necessities, but for reassurance, meaning, and status. The same thing happened in previous Gilded Ages. History repeats and so do markets.

Gilded Ages don’t last forever, they crumble at some point and change, either to a depression economy or a more normal one. The space closes. Before you try to do something really hard to make money, think about a few principles of the Gilded Age. They could provide you an alternate route which is open right now.

Principle 1: Sell The Mystical Edge

It sounds insane. And it is. But it’s also perfectly logical once you understand the economics of exhausted optimization.

If you’ve covered everything for your kids (secured finances, tutors, college funds) what’s left to give them is an edge. You start buying insurance against invisible forces. The invisible forces are the mystical edge. It’s unscientific by definition, because if it were completely provable and concrete, you’d already have it. In the age of competitive parenting and the race for top schools and jobs, it’s an edge.

The same impulse animated both Gilded Ages, the late 1800s and the 1920s, when séances and psychics sold elites access to hidden knowledge. J.P. Morgan was fascinated by Astrology because he was looking for mystical edge in business:

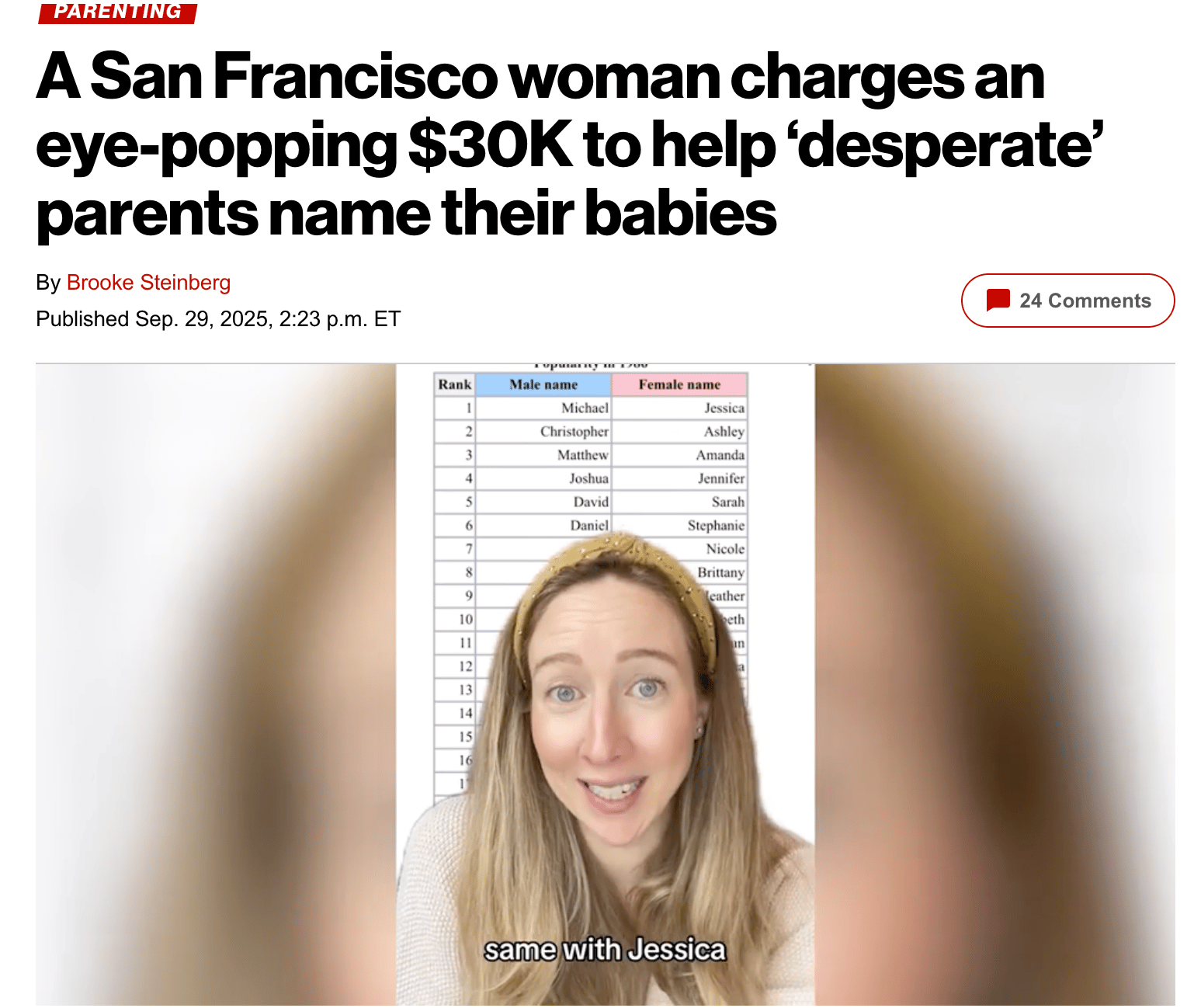

Do baby names matter? Yes, a little bit. Studies show identical resumes with different names receive different callback rates. They shape first impressions before personal interaction overrides the signal. Narrative identity theory suggests people grow by editing the story others began for them. But it is a little crazy when you see baby naming in action.

@whatsinababynamedoula Replying to @lauren Some one-syllable boy names that go with Maeve and Otto could be: Rhys, Teague, Von, George, Pierce, Alec, Clive, or D... See more

Hiring a baby name consultant is purchasing the feeling that you've optimized your child's outcomes. The consultant provides what parents actually need, permission to stop worrying about this particular thing. The consultant provides the edge.

The edge is found in a lot of health protocols these days as well. Consider the biohacker charging $15,000 for a 'longevity protocol' involving peptides that haven't cleared FDA trials. What happens if you’re already fit? You’ve conquered the basics. What's left? The experimental edge. BPC-157 for tissue repair. Epithalon for telomere lengthening. NAD+ infusions for cellular energy. None of these have long-term human studies. That's precisely the appeal.

Updates this past week:

+ 9th week of cycling metformin (currently in off stage)

+ exploring a psilocybin protocol for longevity

+ 5th week of PEMF therapy

+ exploring harvesting my cells→ iPSCs → organoids

+ sent out urine for heavy metals testing

+ waiting for my semen— Bryan Johnson (@bryan_johnson)

12:05 AM • Oct 14, 2025

Once you’ve optimized everything that can be measured, only the immeasurable still feels valuable. J.P. Morgan had astrologers. We have baby-namers and peptide clinics. Same principle.

1) Monetizing Authenticity: Buying reality

2) Capturing Loneliness: Buying belonging

3) Selling the Map to the Labyrinth: Buying guidance

4) Adventure: Buying vitality and risk.

Principle 2: Monetize Authenticity

Massive wealth seems to always correlate with scale. Rockefeller scaled oil. Carnegie scaled steel. Bezos scales everything. They became wealthy by making everything the same and selling it to everyone. Then they used their fortunes to purchase the opposite.

J.P. Morgan financed steel mills, then spent millions collecting medieval manuscripts. Henry Ford perfected the assembly line, then built Greenfield Village to preserve the pre-industrial world his factories destroyed. The Vanderbilts made railroad fortunes on mass transit, then built Biltmore Estate with hand-carved everything, cosplaying as French nobility.

The tech CEO who builds platforms that homogenize culture isn't consuming his own product. He's buying artisanal goods and pursuing individual experiences.

Always a good reminder that the people making these products are not using them. Zuck is spending his time doing MMA training, running a business, reading, buying Hawaiian real estate and talking to people.

This is meant for you. Not him.

He sells you plastic and rubber so he

— LindyMan (@PaulSkallas)

7:37 PM • Sep 26, 2025

Here's the opportunity, you don't need to be the one building scale. You just need to sell to the people who did. Every platform that homogenizes culture creates customers desperate to buy their way back to something real. That desperation is a market.

Brunello Cucinelli sells $3,000 cashmere sweaters with attached manifestos about dignity and craft. His customers are buying reassurance that values still exist.

Here's a day in the life of Brunello Cucinelli.

The man behind the multi-billion dollar quiet luxury sensation.

Sprint, rest, focus. And allocate time for distraction.

— adriane schwager (@aschwags3)

11:17 AM • Jun 6, 2024

Third-wave coffee roasters sell $40 bags labeled with elevation, soil type, and the name of the picker.

The trad wife influencer living on the luxury farm estate

@ballerinafarm Breakfast sausage quiche with a simple green salad from the garden.

The Ceramicist selling $80 mugs on Instagram with studio process videos

Every successful authenticity business rests on three elements.

First, visible craft. You must show the maker, the materials, the process. The ceramicist posts slow-motion videos of clay spinning on the wheel. The knife-maker films the blade being quenched, the hiss of hot steel hitting oil.

Second, artificial scarcity. The phrases "small batch," "limited run," or "waitlist full until March" aren't logistical constraints, they're marketing assets. Availability signals mass production. Unavailability signals value.

@edgyalbert Casatlantic is obviously doing the Mediterranean chic Mr. Ripley vibe the best #fyp #casatlantic #mensfashion #knitpolo

Third, origin mythology. Every product needs a founding story. The coffee roaster who quit finance to honor his grandfather's Guatemalan farm. The furniture maker who rejected IKEA to learn traditional joinery. The rebellion narrative does two things, it positions the product against a soulless alternative, and it lets the customer participate in that rebellion through purchase.

Every billion-dollar platform that homogenizes culture creates millions of people desperate to buy their way back to something that feels real.